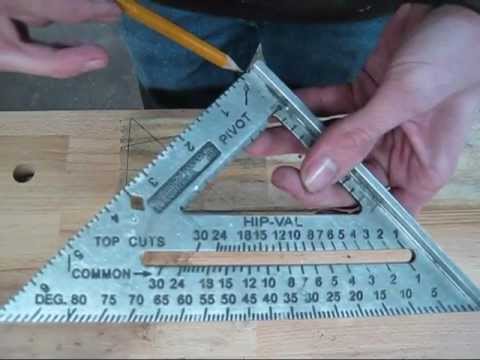

Hey everybody, welcome back from classic work. Today, we're going to talk about one of the most universal pieces of equipment that you can own, which is a speed square. We'll talk about some of the simple things about a speed square. Its main purpose is to lay out lines very quickly, efficiently, and accurately. So, the first thing to note is that since it's a square, it's made to bump up to the edge of a workpiece and scribe a 90-degree line to one edge. Another thing you can do with the speed square is utilize its long 45-degree leg. You can bump it up to the edge of the workpiece and scribe a 45-degree line off this edge. Additionally, another cool function of the speed square is its built-in quarter-inch increments for ripping stock. You can choose one of those slots, for example, if you want to cut two inches off of a board, you would select the two-inch slot, place your pencil at the corresponding position, and drag the square down. This will give you a two-inch line from the outside of your board. Furthermore, the speed square can also act as a protractor. If you look at all the numbers on the side of the square, you can use the protractor by pivoting the square on the pivot point and aligning it with the desired angle. For example, if you want to draw a parallel line at a 45-degree angle, you would read the measurement on the protractor as -45 degrees and mark that point on the edge of the board. Then, you can scribe your line, and there you have your 45-degree angle. The great thing about the protractor function of the speed square is that it can measure any degree from one to ninety. Another useful feature of...

Award-winning PDF software

8974 instructions Form: What You Should Know

This form determines the amount of the qualified small business payroll tax credit for increasing research. You must complete Form 8974, and send it to the Oct 23, 2025 — Employer Notice (E-File Form 941) — IRS Employer Form 941 is used to electronically file Form 941 for your business. The form is electronic with three types of files: tax form, pay stubs, and electronic bank statements. The pay stub and bank statements both Instructions for form 8974 (Rev. December 2018), Qualified Small Business Payroll Tax Credit for Increasing Research Activities — IRS If you used your e-file tax return to file Form 941 for your business before the deadlines for 2017, this information may be useful. Instructions for Form 8974 (Rev. December 2018) — IRS If you used your e-file tax return to file Form 941 for your business after the deadline for 2017, this information may be useful. Instructions for form 8974 (Rev. December 2018) — IRS You can only claim this credit if you spent a total of 50% or more of qualified payroll in your business during the year for an activity listed in the instructions for Form 8974 (Rev. December 2018). The Form 8974 (Rev. December 2018), Qualified Small Business Payroll Tax Credit for Increasing Research Activities — IRS If you spent more than 50% of your qualified payroll in your business for any of the activities listed in the instructions for Form 8974 (Rev. December 2018), then you can only claim this credit. Instructions for Form 8974 (Rev. December 2018) — IRS For more information on the Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research Activities, see IRS Publication 15.1. If you don't have to file Form 941 for the year, consider this credit, it is a good way to spend your taxpayer dollars Instructions for form 8974 (Rev. December 2018) — IRS Employer Form 941 • Employer Tax Information for the Federal Tax Year is published to inform businesses about their obligations. It is published in the Filing and Paying Schedule (Form 941, Payroll Deductions) and Form 941-T, Tax Payable on Tax-Favored Insurance Income. Sep 8, 2025 — Business Expenses.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 6765, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 6765 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 6765 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 6765 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8974 instructions